money

5 humble habits to help build serious savings

4 min | 20 November 2023

One of the paradoxes of wealth? We can start building big wealth by taking seemingly small steps. Short of winning the lottery, many people may go their whole life without a huge lump sum landing in their bank account. So, what modest moves can we make to help build wealth in the long run?

1. Become a track star

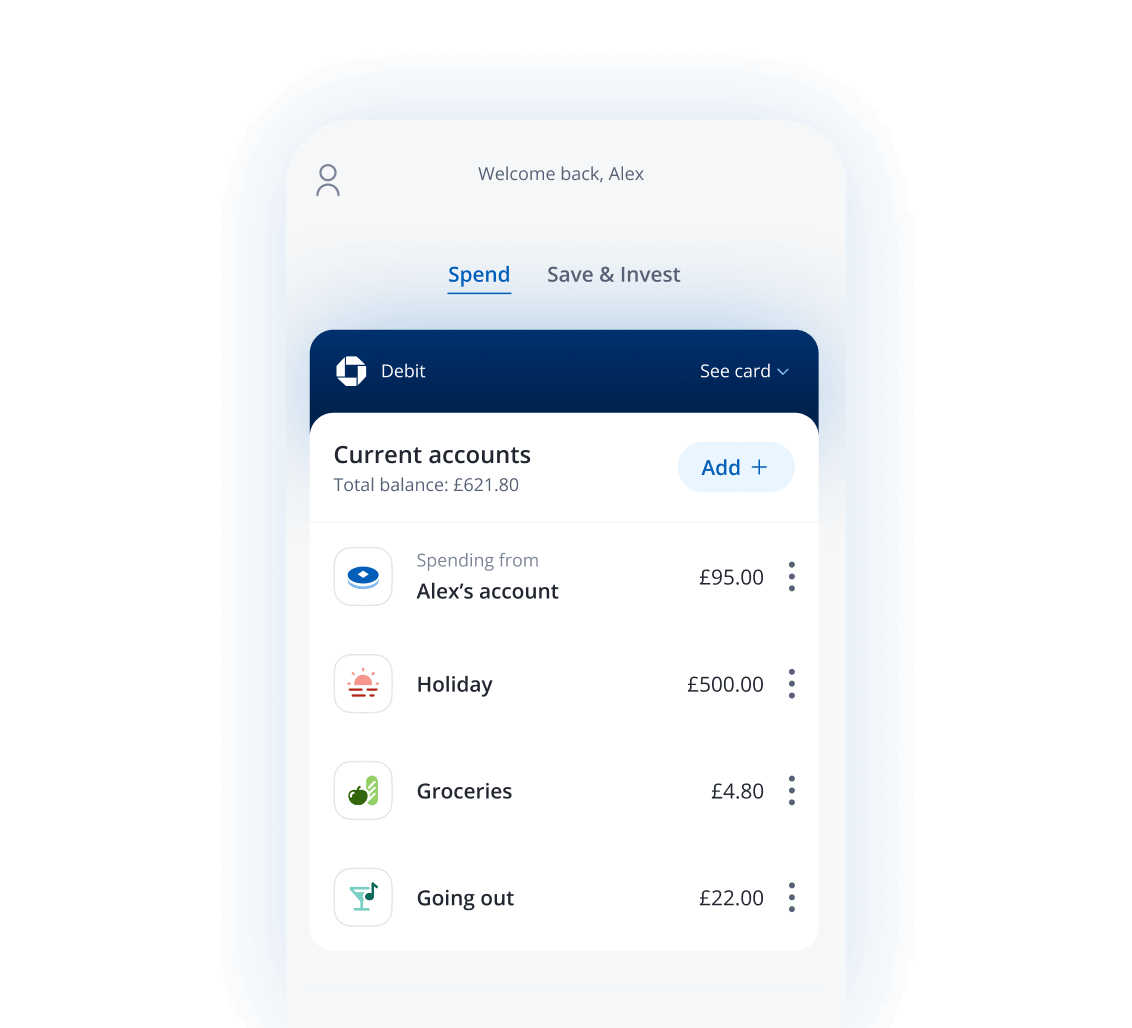

It may sound counterintuitive, but before you start actively doing anything, it’s a good idea to work out the lay of the land right now. And a great way to do that is to track your cash flow. For example, how much do you actually spend on food? It’s not just your weekly grocery run, but the mid-afternoon chocolate bars from your office canteen, and the evening takeaways when you can’t bear to cook.

Subscriptions, online shopping, late fees and delivery costs. Track it all in a budget to see where you’re spending, and importantly, where you can easily start saving.

2. Small wins

Now that you know exactly where you’re spending, you could decide to strike off the outgoings that you wouldn’t miss. As well as potentially dropping one of your suite of streaming services, you could also make the most of extras that you already have access to.

For example, with Chase, you could earn 1% cashback on your everyday debit card spending¹ – that’s basically free money. You could also make sure you’ve activated all perks on loyalty programmes, such as earning air miles from your grocery supplier's loyalty card for example.

¹18+, UK residents. Cashback available for your first 12 months as a new customer. Max £15 per month. Cashback exceptions apply.

3. Big wins

OK – chances are nobody made it big purely from collecting cashback – although it certainly can’t hurt. But there are ways you can make a big impact on your income and outgoings: by addressing your largest transactions. Can you cut your rent by bringing in a roommate? Can you save on transport costs by cycling instead of getting the train or driving? Can you set up a side hustle to bring in an extra income stream? Thinking creatively about how to impact the biggest outgoings, or supplement your income, can be great ways to step along the path of building wealth.

4. Autopilot those pounds

When you put your cash into savings, the wonders of compound interest work in your favour. You earn interest on the amount you initially saved, as well as the previous interest earned.

With debt (such as a credit card), paying the minimum due each month only pays off a small portion of the amount owed. If possible, set up a payment that's more than the minimum. If you can afford it, pay down your short-term borrowing in full each month but ensure any secured lending is the priority. And even better if it's automated. After all, you may have the best intentions of paying all your bills in full, but if it were to slip your mind, the result would be added interest as well as potential late fees.

Automating as many bills as you can, with Direct Debits or a standing order, is a great way to keep repayment costs as low as possible.

5. Pay yourself first

One of the ‘golden rules’ of personal finance is a simple one – reverse budgeting. Put simply, first, pay your bills and various financial obligations. Next, send money to your savings and investments. Then, whatever's left over, you are free to spend. That way, you’re not just left with the dregs of whatever you didn’t happen to spend that month. Instead, you’ll be able to prioritise building your savings and your wealth – while meeting your other financial responsibilities.

Of course, this depends on how much disposable income you have – and it will require the spend tracking from earlier to make the numbers make sense. Even if it’s a nominal amount, getting in the habit of ‘saving first, spending second’ is a great idea. Bonus points – automate this as well for seamless money moves.

Recommended reading

- How to practise mindful spending

- Understanding why we spend money

- How to say no when money's tight

Disclaimer: The Hub is intended as a knowledge portal to provide information on a range of topics, including financial products. Articles may reference products and services which Chase UK does not currently offer. This article is for information only and does not constitute financial advice. We do not offer any tax advice.

The new way to bank

Get to know the Chase current account. It's packed full of rewards and clever features that we think you'll love.