Chase enters insurance market with launch of insurance bundle for U.K. consumers

| 4 February 2026

London, 4 February 2026: Chase has today launched its first insurance product, offering U.K. customers one of the best value options on the market for essential coverage.

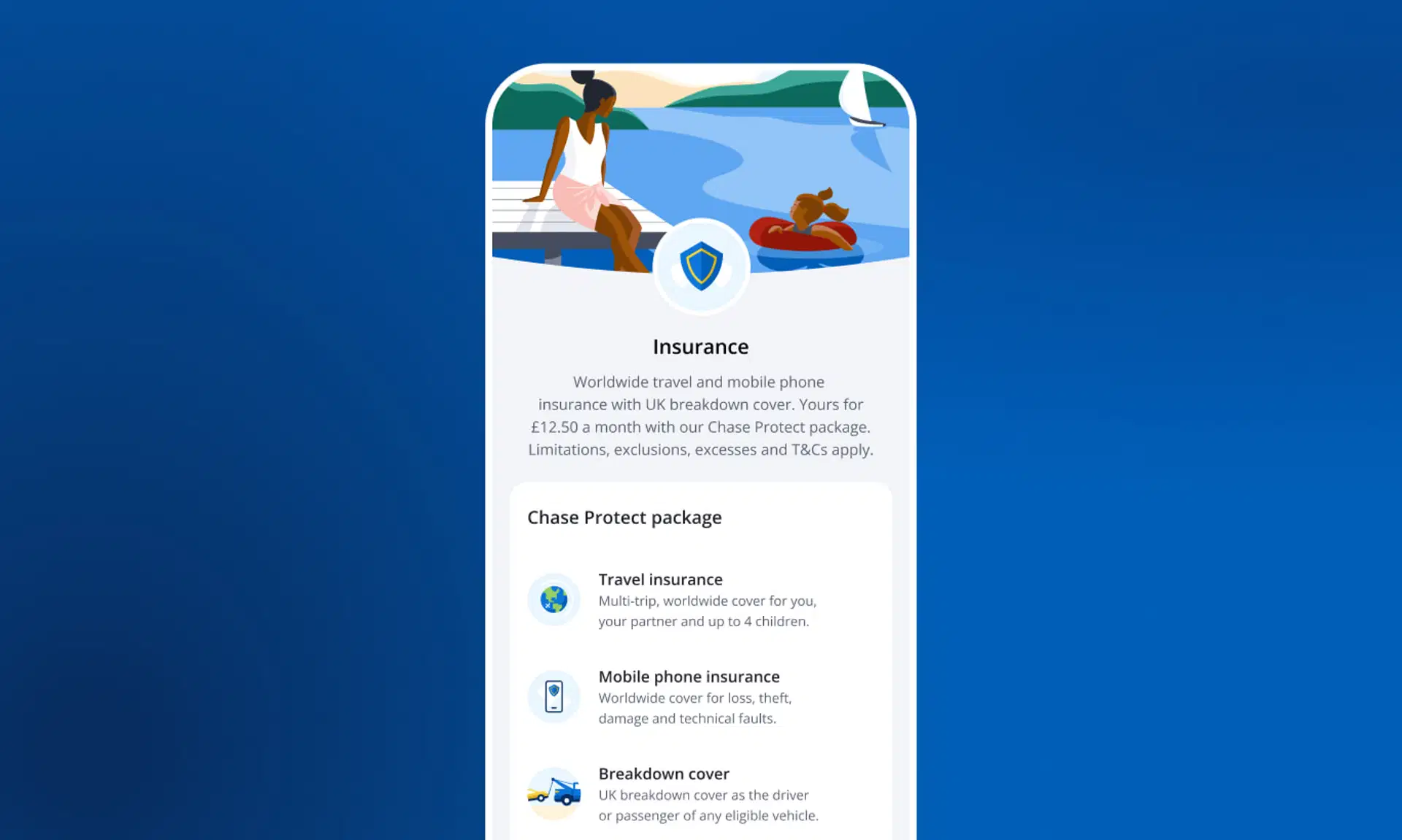

Chase Protect* offers an easy-to-manage bundle of worldwide travel insurance, mobile phone insurance, and AA U.K. Breakdown Cover, available at a fixed monthly rate of £12.50.

The package is designed to provide customers with a straightforward and convenient way to protect themselves from common risks.

Chase has prioritised creating a seamless app-based experience for customers looking to take out cover.

Customers can purchase and manage their cover, and submit any claims via the Chase app.

Harish Iyer, Head of Insurance at Chase, commented: “We’re excited to introduce Chase Protect, a simple and affordable way for our customers to safeguard what matters most. By bringing together essential insurance coverage in one easy-to-manage bundle, we’re helping make protection more convenient and better value - all via the Chase app.”

Chase’s insurance product is available as an add-on to its current account, with customers able to access a range of other benefits by signing up to Chase, including a competitive easy-access savings rate with the Chase Saver account, round-ups, cashback** on their spending, and much more.

The product is being rolled out in stages to customers from today.

Notes to editors

Insurance type | Key coverage and limits |

|---|---|

Travel insurance (provided by Collinson Insurance) | Multi-trip cover is provided for the policyholder, their partner, and up to four children, allowing families to travel with confidence knowing they have a solid safety net. Includes:

|

Mobile phone insurance (provided by Assurant) | Worldwide cover protects you against loss, theft, damage and technical faults:

|

Breakdown cover (eligible personal vehicle) (provided by the AA) | UK wide breakdown cover with:

|

Insurance type | Travel insurance (provided by Collinson Insurance) |

|---|---|

Key coverage and limits | Multi-trip cover is provided for the policyholder, their partner, and up to four children, allowing families to travel with confidence knowing they have a solid safety net. Includes:

|

Insurance type | Mobile phone insurance (provided by Assurant) |

Key coverage and limits | Worldwide cover protects you against loss, theft, damage and technical faults:

|

Insurance type | Breakdown cover (eligible personal vehicle) (provided by the AA) |

Key coverage and limits | UK wide breakdown cover with:

|

*Limitations, exclusions, excess and T&Cs apply.

**Customers can earn 1% cashback on debit card spending on:

- Groceries – e.g. at grocery stores, supermarkets, miscellaneous food stores, convenience stores and specialty markets

- Everyday transport – e.g. local and suburban commuter passenger transportation (including ferries), bus lines (including charter/tour buses), railroads and passenger rail (trains)

- Fuel – e.g. service stations (with or without ancillary services), automated fuel dispensers and electric vehicle charging points

18+, UK residents. Eligibility applies. 1% cashback on this debit card spending for your first year. After your first year, customers need to pay in £1,500 (excluding internal transfers) to your Chase current or saver account each month to qualify. Max £15 per month. Exceptions apply. May be changed or withdrawn.

About Chase in the U.K.

Chase is the consumer banking business of JPMorgan Chase & Co (NYSE: JPM), a leading global financial services firm with assets of $4.4 trillion and operations worldwide.

The U.K. bank is designed specifically to meet the needs of customers in the country, providing a range of banking products and features. Launched in September 2021, Chase serves over two million U.K. customers and was named Best British Bank (2023 & 2024) and Best Current Account Provider (2023-2025) at the British Bank Awards. It was also named Banking App of the Year for the second consecutive year at the MoneyfactsCompare.co.uk Awards 2025.

In November 2025, Chase was named a Which? recommended provider for its current account for the first time.

In the U.K., Chase is a trading name of J.P. Morgan Europe Limited. J.P. Morgan Europe Limited is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. For more information, go to www.chase.co.uk.