security

Be vigilant about these scams in 2023

5 min | 10 May 2023

The rise in the cost of living means we should be even more vigilant about potential scamming and those who are looking to take advantage. With the UK amid a fraud epidemic, here are some of the main types of scams to be aware of so far this year.

Scammers are always looking for new ways to commit fraud, but they can also turn to old tricks to catch you off guard. Either way, their actions can leave victims out of pocket and, in some cases, unable to obtain credit or hold a bank account.

Investment and cryptocurrency scams

How it works: Fraudsters appear on dating or social media platforms and forge a fake connection with someone to get them to ‘invest’ in fake investments, including cryptocurrency. Often promising high, unrealistic returns, they can even fabricate ‘updates’ showing how your money is growing when in reality they’ve pocketed it for themselves.

How to help protect yourself: Do thorough research on any investment idea and check the FCA Scam Smart Investment Checker to help understand if the investment opportunity could be a scam. An opportunity that seems too good to be true – especially in an unregulated area like cryptocurrency – should raise a red flag even if it sounds professional and detailed.

Money mule requests

How it works: Money mules are people who – knowingly or not – transfer illegally obtained money between different bank accounts, with the expectation of keeping some of it for themselves. Social media is ripe for recruiting money mules. In particular, children and young adults are increasingly becoming victims via ads or videos with the promise of easy money. Some are even hustled by scammers at their school gates.

How to help protect yourself: Be suspicious of posts from people advertising things like 'quick, easy cash' – a mule advertisement could ask you to move funds through your bank account 'from the comfort of your own home'. That’s your cue to stop the conversation and file a report to the Action Fraud service

UK Finance and CIFAS have a dedicated website with helpful information.

Spoofing

How it works: Spoofing is when you receive an email, text or call from someone impersonating a trusted organisation (such as your bank), alleging a ‘problem’ with your account or recent order. It will ask you to follow a link or give them your personal details. This could result in your details falling into the hands of scammers who may use them maliciously.

How to help protect yourself: Always remember that a genuine organisation will never ask you for detailed personal information in an email, text or cold call. Caller IDs can be spoofed too, so don’t assume it’s genuine because it looks like an official source. Check that the spam filters on your email accounts are activated and don’t click on any suspicious email links. If you’re not sure if an email is genuine, contact the bank or business directly through contact details on their official website, flagging the email in question. You can also file a report with Action Fraud

Online purchase scams

How it works: Online purchase scams involve transactions you make for goods or services that do not exist. Fraudsters will take out misleading ads online, tempting victims with cut-price offers for goods that are normally high-value. These scams can be difficult to detect because the websites created by the scammers look authentic.

How to help protect yourself: Look for errors on the retailer’s site like grammatical mistakes, stock images and incomplete contact details. Check independent seller reviews through sites like Reviews.io or Trustpilot Remember, if an offer looks too good to be true, it probably is.

With scammers looking to old and new ways to commit fraud, it’s still possible to stay vigilant and keep your money safe.

If you think you might be the victim of a scam or fraud involving any of your Chase accounts, please contact us right away.

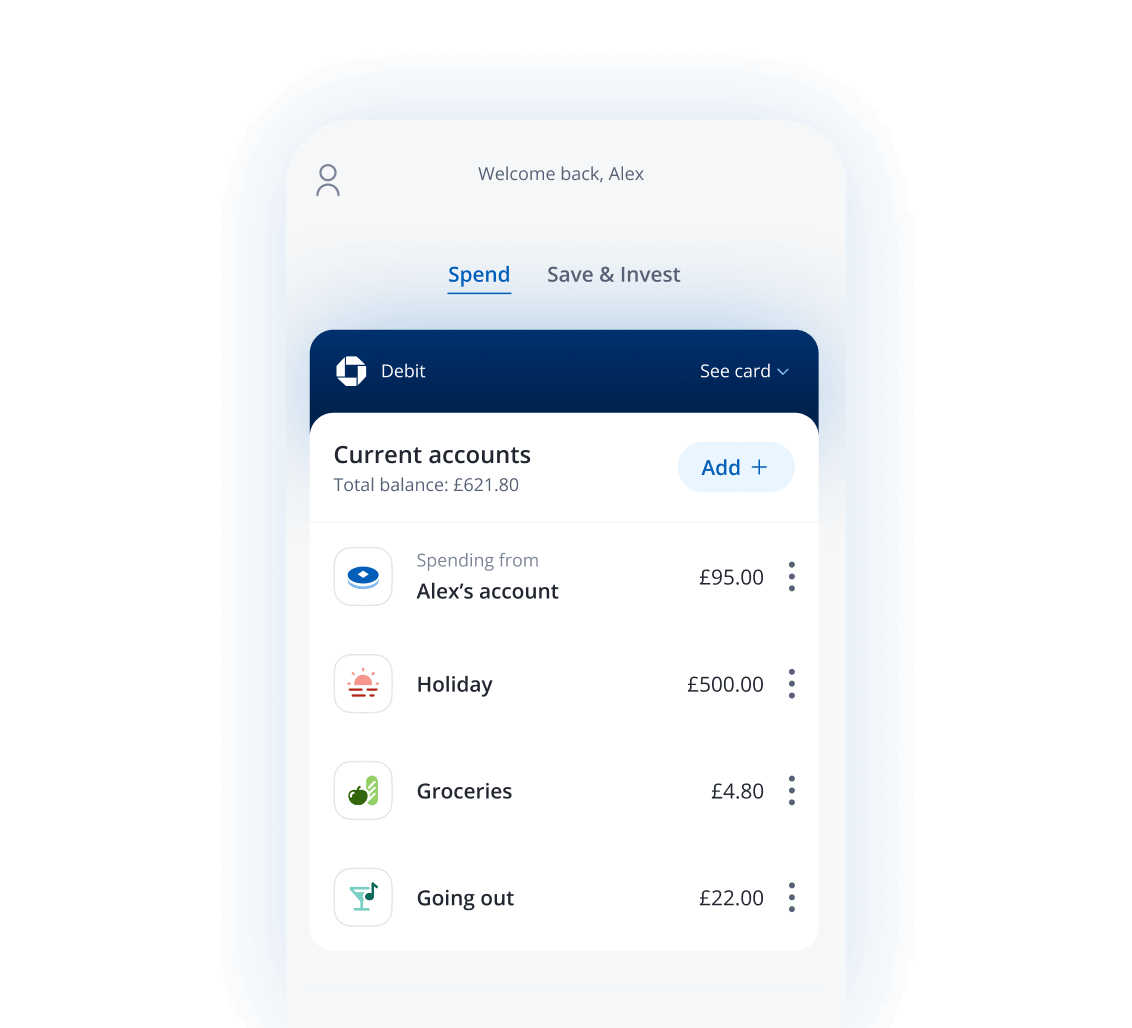

The new way to bank

Get to know the Chase current account. It's packed full of rewards and clever features that we think you'll love.