money

Hacks to make saving money fun

5 min | 30 October 2023

Putting the fun into saving money sounds like a contradiction, right? But a great time to look at ways you can save some cash is now – even if it’s a small amount every week or month. We’ll run through some simple tips and challenges to help get you started.

But first, the science behind why it’s so hard to save

The good news is, it’s not all our fault. Humans are hard-wired to value the present moment over the future (especially when it comes to intangible things like money). There’s actually a fancy name for it – ‘present bias’. Constant overspending comes from not taking enough time thinking about the future, and toomuch time living in the moment. So, it makes sense that pausing for a minute and being more mindful about your spending can be a great way to make smarter financial decisions.

It doesn’t mean you stop having any fun, but if your saving habits are taking a hit (or are non-existent), it’s probably time to try a new approach. Think ahead to your future and what it might look like and line up your saving habits with those goals. Taking up a challenge like the ones we’ve suggested here might be a great place to start.

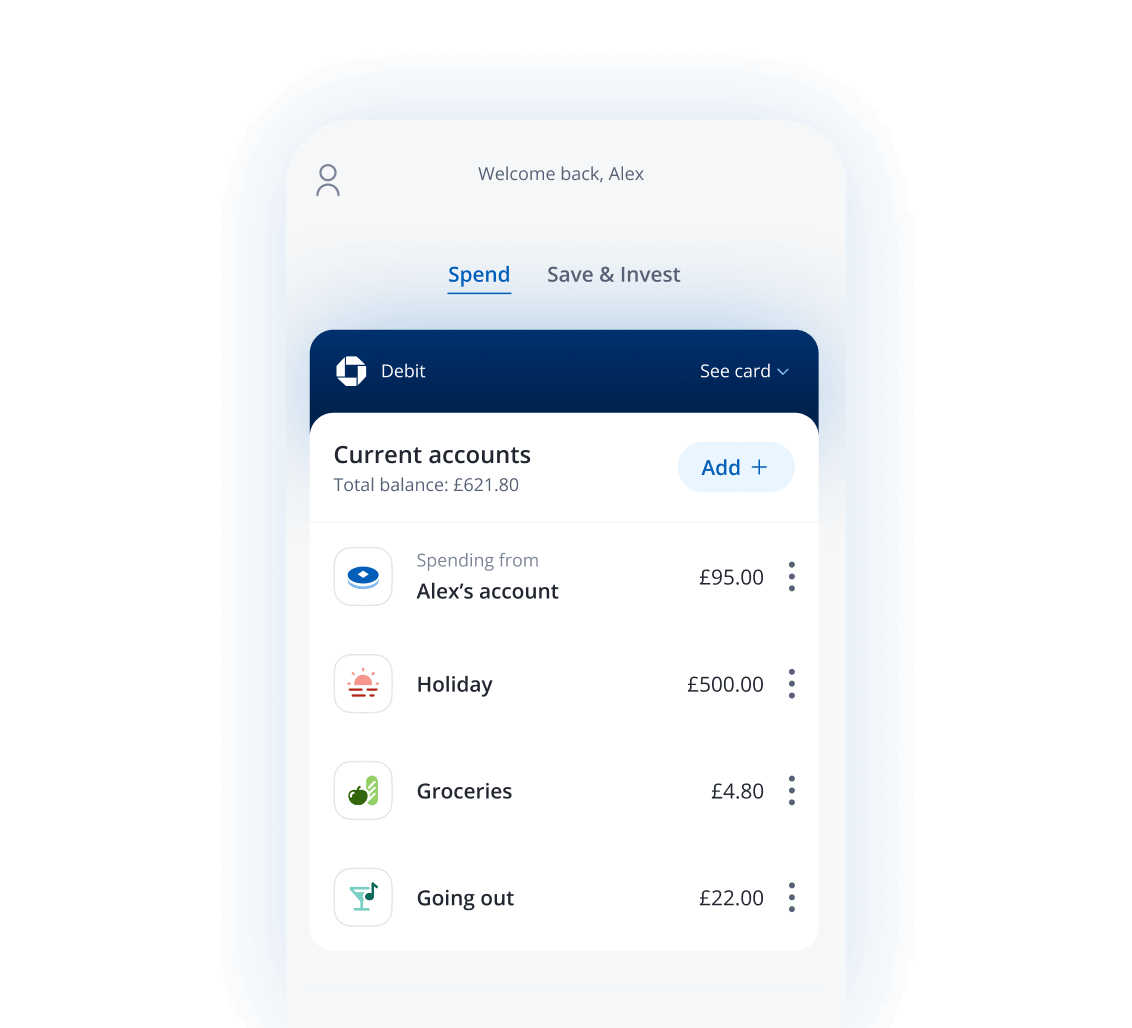

You may want to consider a simple savings account (such as a Chase saver account) dedicated to holding the money you're about to start saving. This way you’ll know

exactly how you're doing (and will avoid mixing it up with other accounts). You can find plenty of visual aids online to print off and help motivate you with some of these challenges too. Once your savings account is up and running, here are five ideas to help you fill it:

1. Save a pound a day

As simple as it sounds. Literally put aside a pound, every day. Make things easier by setting up a standing order from your current account into your savings. Try this for a year and you’ll have £365 to show for it.

2. Save 1% of your monthly wage

This one gives you a better understanding of how much you’re earning and how putting a small percentage of it aside could add up in the long term. Calculate 1% of your monthly wage (after deductions) and arrange a standing order for this amount into your savings. If you set it up for the same day you’re paid, you’re less likely to miss it. After a year (or sooner if you can manage it), try upping the percentage.

3. The 52-week challenge

At the end of week one, save £1. At the end of week two, make it £2. Carry on increasing the amount until week 52 (when you’ll be saving £52). By doing this, your savings for the year should be £1,378.

4. Try the no-spend month

Don’t worry – we’re not saying you can’t spend any money for a month. Make a list of the things you will need and another of ‘nice to haves’ that aren’t essential. Scrap the latter for a month and you could save a surprising amount. Here are some examples of both:

Essentials

- Mortgage/rent

- Utility bills

- Basic groceries like fruit, vegetables, pasta, milk and toiletries

- Travel costs

Non-essentials

- Takeaways – including everything from coffee to sandwiches to dinner

- Eating out in restaurants

- Salon treatments or haircuts

- Non-essential clothes

- Entertainment (like the cinema)

Note down a ‘normal’ monthly spend on those non-essentials. Then once you’ve done the hard work of getting through your no-spend month, transfer the money you

would have spent into your savings.

5. Sell to save

Look around your home and list stuff you haven’t used or worn for a year that could be sold online (or at a car boot fair, or garage sale). Put the proceeds straight into your savings for an easy win.

How to stay motivated

Think of a goal that's specific to you – it could be a big one like saving for a car or a deposit for a house. Maybe it’s clearing down credit card or student loan debt and building a healthy emergency fund. Whatever your motivation, make sure it’s present in your daily spending thoughts and remind yourself of it whenever you can (so you’re putting money away towards it).

Even something as simple as sticking up motivational sticky notes can help. By taking your savings seriously (and only dipping into it when you really have no other option), it should become just as important in your life as the way you spend your money.

Looking for an account to keep your savings? Bank with Chase and you can open a saver account. Start saving with as little as you like, and we’ll calculate your interest daily and pay it monthly.

18+, UK residents. A Chase current account is required to open a saver account.

Recommended reading

- Six smart reasons to keep saving

- How I saved it, how I spent it

- Your guide to guilt-free spending

The new way to bank

Get to know the Chase current account. It's packed full of rewards and clever features that we think you'll love.