money

How to save cash and earn perks by working the system

6 min | 29 August 2023

Finding more cash to spend on the things you love may be easier than you think. Knowing some tips to 'work the system' is a good place to start.

Most of us avoid what we dread. When you come home from a hard day, sorting through your monthly outgoings is likely the last thing you want to do. But what if by combing through your receipts, bank and credit card statements, you could spot ways to save enough cash to pay for a holiday or even something practical like a new laptop?

We reveal tips on how to navigate your money fearlessly. Trying out some of these tips could stretch your cash further, helping you afford your dream purchases.

Four ways to get the best out of the banking system

- Balance transfer deals can be a great place to start getting more for your hard-earned money. If you’ve got a credit card and are not paying it off each month, you’ll likely be paying interest, so it might be worth considering switching to a 0% balance transfer. This means you’ll transfer your balance to a new card, which will be interest-free for a set amount of time, such as 18 months. By slashing your interest to zero, you could save a bundle, but beware as some providers may charge a fee. A 0% balance transfer card could help you save money on interest, and you can use these savings to pay off what you owe quicker. This could reduce the amount you're using of your available credit, helping improve your credit score.

- Paying your credit card bill in full is a good discipline: it helps keep you out of debt, eliminates interest payments and can improve your credit score. If you can’t pay your balance off in full, paying more than the minimum will help keep your interest payments down. Also consider timing payments with your payday to make it less painful, and set up a Direct Debit or standing order so you don’t forget.

- Credit card loyalty or debit cashback deals can provide retailer discounts, 'freebies' or cashback on purchases. Typical perks may include hotel and holiday deals, air miles, 2-for-1 meals, and other discounts at participating shops and retailers. Some deals will change more often than others, so check if you can access the deals easily so you can take full advantage. If you can get cashback on all or some retail purchases, consider using those savings to pay back bills or put away more in savings.

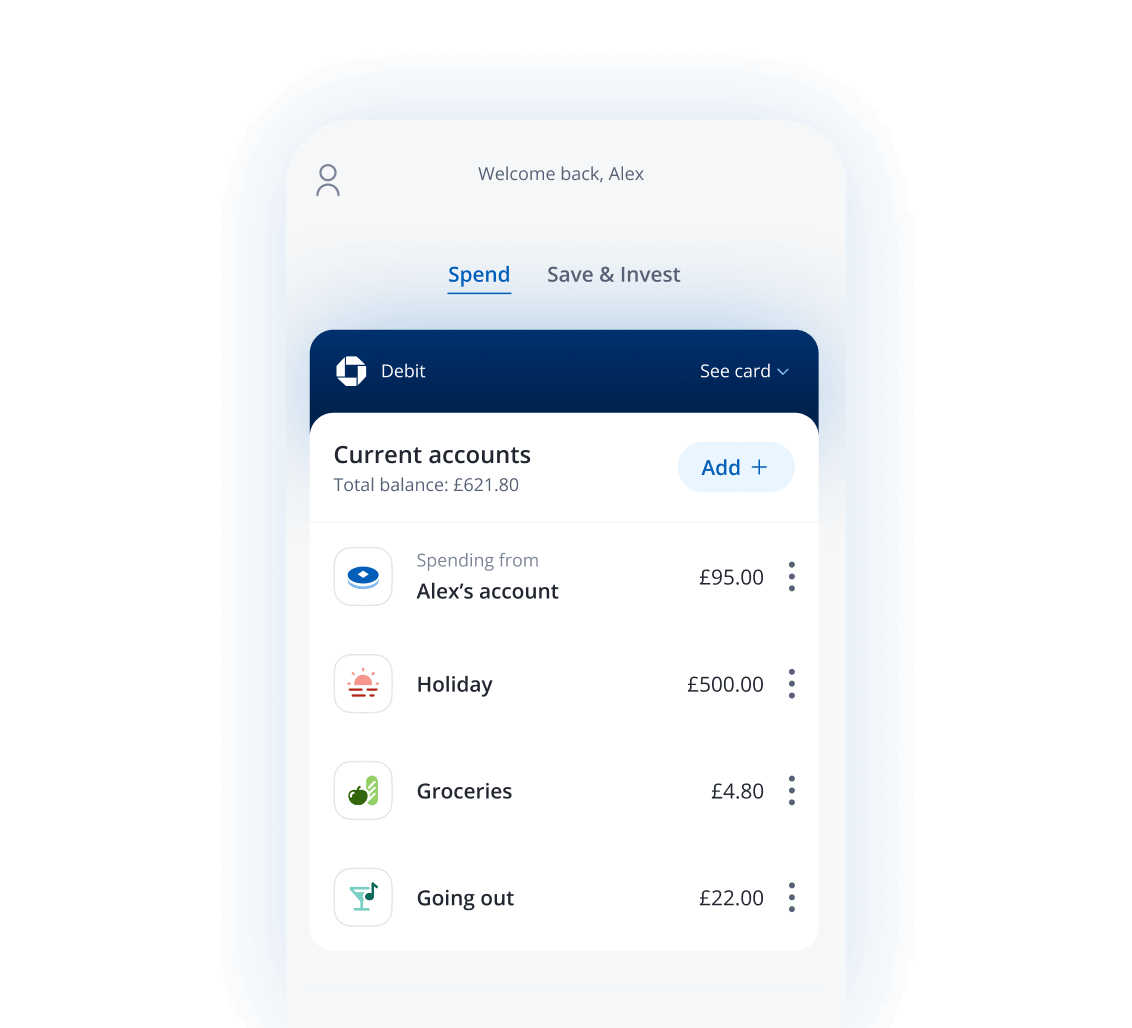

You might want to check out the cashback and rewards that we offer to Chase customers. - 'Premium' bank account perks could include, for example, travel insurance, breakdown cover, cashback and air miles. Sometimes these perks are only available with a ‘premium’ account, so you may have to pay a monthly fee for the privilege, and you should check that these perks are actually useful to you. Also check if retailer discounts are available through your premium account.

Achieve financial goals faster with automated payments

Sometimes it pays to put your savings to work, and automated payments can be a great tool for this.

For example, if you can afford to save a set amount of money each month, it’s a good idea to set up a standing order from your current account to your savings or investment provider. This way, you’ll have less opportunity to spend the extra.

Equally, if you ever get a cash bonus at work, you may want to consider a bonus sacrifice with your employer. That means you automatically pay your bonus into your pension instead of having it paid into your bank account. This can save a significant amount of tax money that will now be allocated to your pension instead (although this will depend on your individual circumstances).

Good credit scores can lead to future benefits

Having a good credit score now could mean a lower interest rate on a loan or a successful mortgage application later. Those with higher credit scores may also have access to more providers and deals. That’s why it is important not to fear knowing your credit rating, but rather access your report so you can take care of it. You don’t even need to pay to access your credit report; there are services out there that allow you to view it for free.

Eliminate mistakes: One way to improve your credit score is to make sure there aren’t any mistakes on your credit report. Inform the credit reference agency of any errors.

The agency then has 28 days to remove the information, amend it or tell you why it isn't taking any action. During that time, the 'mistake' is marked as 'disputed', so lenders are aware of this when assessing your credit rating.

If the error is erased, it could boost your credit score, which may give you access to more financial products and better interest rates.

Check that your report is capturing all your relevant accounts and not just recent ones. You may need to contact your bank to give them permission to share your data with the credit agency.

Register on the electoral roll: Another way to improve your credit rating is to register on the electoral roll because it allows any interested party to confirm your identity and address. It’s usually a must for mortgage providers.

Making additional monthly payments on your credit card, loan or mortgage can give your credit score a boost, but check with your mortgage lender as there may be limitations on how much you can overpay. Other ways you can try to boost your credit score:

- Build up your credit history: Having a credit history means providers can see how you have handled your credit previously. If you have more than one credit card and you need to make a big purchase that you can't afford to pay off immediately, consider using the one with the lower interest rate. Then use the other for smaller purchases that you can pay off in full or quickly

- Loyalty matters: Credit agencies like long-standing credit histories with financial providers. Even if you use one of your credit cards for just, say, emergency or holiday purchases, keeping rather than cancelling the card can help if you keep payments up-to-date or pay it off in full

- Don’t max out your credit cards: Using less than 50% of your available credit rather than maxing out your cards can keep you in better standing with credit agencies

- One at a time: Don't apply for multiple credit cards or loans within a short period of time as this can lower your credit rating for a period

- Don't miss a payment: if you can't afford the payment, it's better to contact your lender beforehand and explain your circumstances

How haggling can save on everyday essentials

From phone contracts to getting a leak fixed in your flat to getting a discount on a car or a sofa, you never know when you might be able to negotiate a better deal.

If you don’t ask, you don’t get, right? What’s the worst that could happen? They don’t give you as big a discount as you asked for, or there’s no discount and you’re in the same position as before you asked? Go on, put your cringe aside and haggle with the retailer or seller.

Related reading

- What to do if your credit score is affected by fraud

- How much could you save by kicking your bad habits?

- What is cashback and how does it work?

The Hub is intended as a knowledge portal to provide information on a range of topics, including financial products and lifestyle management. These articles are not financial advice. Articles may reference products and services which Chase UK does not currently offer.

Disclaimer: This article is for information only and does not constitute financial advice. Tax treatment depends on your individual circumstances and may be subject to change in the future. We do not offer any tax advice.

The new way to bank

Get to know the Chase current account. It's packed full of rewards and clever features that we think you'll love.