life

Money on the mind: how culture influences our ideas about money

5 min | 26 September 2022

Not all of the lessons we learn about money take place at the till. Sometimes, they are influenced by factors like the culture we belong to. Here are some stories about how money and family collide.

My dad always used to tell me that you should only buy a non-essential item when you can buy it twice. Whenever I make indulgent purchases, I think of him saying this to me while I hover my card over the reader. Our attitudes toward money don’t exist in a vacuum – they’re influenced by our friends, education, parents and more. A significant part of this is heritage, how does the upbringing of our parents and grandparents filter down into our relationship with money? I spoke to people from diverse backgrounds to understand how their heritage influences how they feel about money today.

"Like most refugees, my Holocaust survivor grandparents were always keen that we had our money readily available. They did not lock money away in long-term accounts in case we ever had to flee last minute – because of this, my family still has a weird thing against putting money in long-term, interest-accruing accounts. This attitude means I leave more money in my current account than people advise, and I only have a little bit saved away."

Joshua, 26

"I have a Gujarati background, though my family has lived in London for as long as I can remember. I’ve never really known extravagance, but my parents and grandparents made sure we were happy, and so we wanted for nothing. My parents taught me to value playing the long game with money over settling for convenience, this means I look for cheaper alternatives or happily wait it out until I get a better price without sacrificing quality. For example, do I need that £3 quality cheddar, or can I just grab the Lidl one like my mum used to? I’m not an extreme saver, but I’d often see my mum stress a lot about money, so I view saving as the primary way to avoid getting anxious."

Maansi, 27

"I grew up with my Jamaican grandparents and mother. My grandparents came to the UK as immigrants and did very well for themselves and they believed enjoying what you have earned was important. However, during our early years, my mother refused help from them and worked two jobs while studying at university to make ends meet because she valued her independence. My mother taught me the significance of having your own money and always having a backup plan concerning your finances, especially as a Black woman. I’m in a relationship now where my partner is older and makes more money. Though I let him pay for things and cover most of our outgoings, I always make sure I’ve got my own money and save wisely because life comes at you quickly."

Shaianne, 25

"My parents believe that money is cyclical and will always find its way back to you, so I grew up with an abundance mindset. My dad always drilled into me: “Hakuna Kufilisika Kwenye Chakula”, which means “there is no loss when it comes to food” in Swahili. He believed that food should be one of the most expensive things someone spends money on, as it is sustenance for the body. My mother is a self-care Arab queen – her outlook on money is that "the reception is always the nicest place because it is where you greet people". What she means by this is that how you present yourself should be a priority. For example, she used to hire makeup artists and hairstylists when she was going out – when I asked her about this, she would repeat: “A witch does not cast spells on herself”, meaning if you want to look good, you should spend the money. Adopting my parents' beliefs has meant that I’ve never worried about money – even as a millennial and living through the worst financial climate. Instead, I have this innate belief that the money is out there."

Aziza, 27

"My parents came from low-income families in Mozambique, one of the poorest countries in the world. They experienced significant challenges that I, as their middle-class child, may never truly understand. Keeping track of your spending was important to them, mainly because they both studied commerce. They taught me the power of investment – not in stocks but in goods and services. For example, they believed in putting your money into good-quality clothing so it would last longer. But, most importantly, although money was necessary to them, they taught me that your financial status should not determine happiness and that having money does not make you better than anyone."

Nicolas, 23

"My mum is English and my dad is Jamaican, and I spent most of my adult life living in Spain. All of these cultures have very different financial dynamics. The culture in Spain taught me that life does not have to revolve around money. Whereas in Jamaica, money always has to be craftily stretched to make ends meet so you can survive. Living in the UK, however, it feels like there is never enough money – there is always something more expensive that is out of reach. So, those three ideas combined gave me a conflicting feeling – although money is not that important, I also believe that I constantly need to make more."

Tiffany, 27

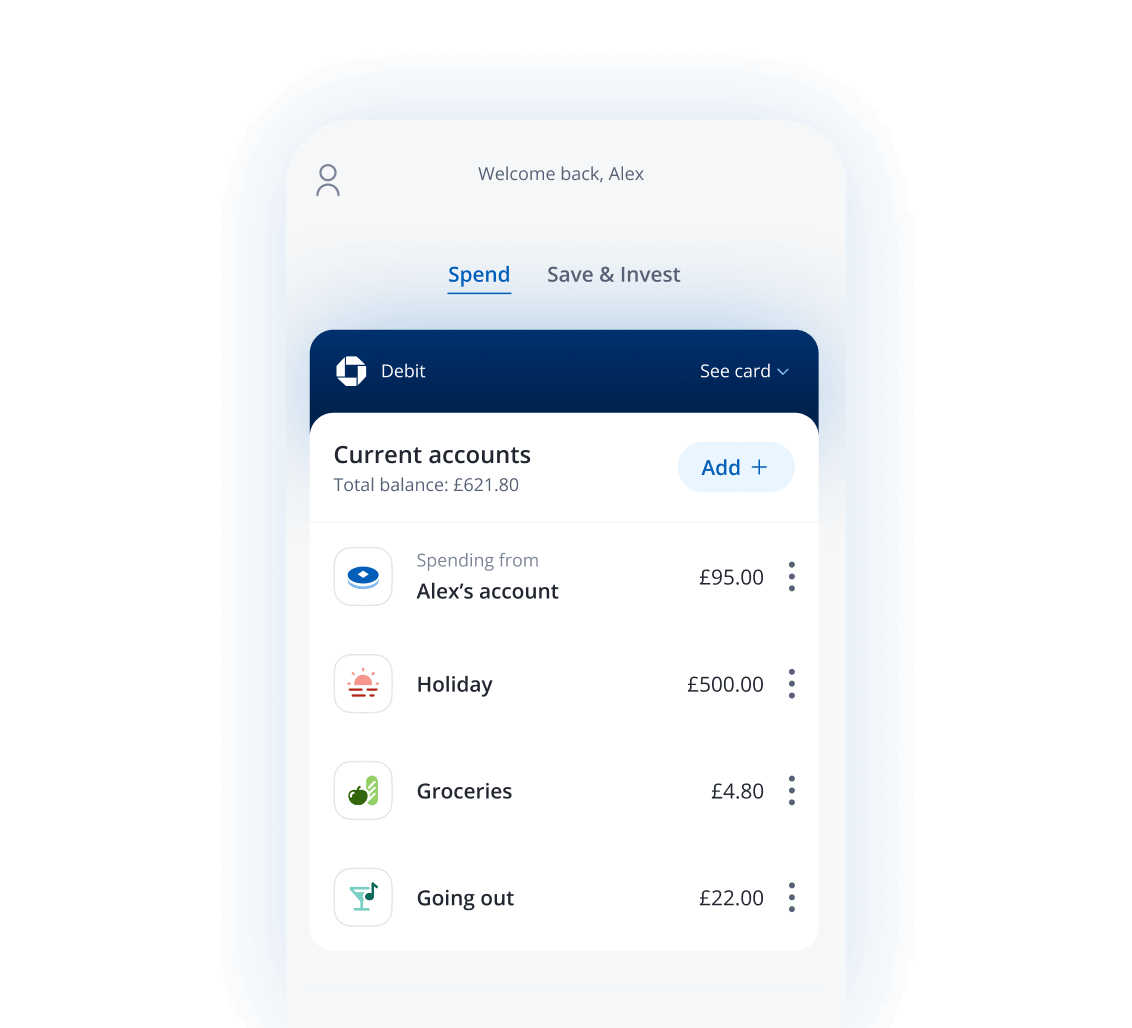

The new way to bank

Get to know the Chase current account. It's packed full of rewards and clever features that we think you'll love.