security

Cryptocurrency scams are on the rise. Here are some things to look out for

6 min | 20 June 2023

Cryptocurrency scams can have devastating consequences, leaving victims distraught and cheated out of their savings. Fraudsters use a variety of tactics to manipulate people into parting with more and more of their money. We look at what to be aware of – and how to help protect yourself.

Put simply, cryptocurrencies are digital currencies, which are created using advanced encryption techniques. You can send and receive the currency virtually through a computer network, which uses blockchain technology to record transactions.

Importantly, crypto doesn't rely on a government or bank, so it's not part of the mainstream financial system. Although British crypto asset firms have to be registered with the Financial Conduct Authority (FCA), crypto assets themselves aren't regulated. This makes it very difficult to recover money if you’re a victim of crypto fraud – you should be prepared to lose your money if it turns out to be a scam.

In 2021, around 2.3 million adults in the UK held cryptocurrency assets. If you've ever bought a fraction of a Bitcoin, for example, you've owned some crypto.

What are the types of cryptocurrency scams to be aware of?

Scams involve pressuring people into transferring money from their bank accounts to a fraudulent scheme. Other valuable information can also fall into the wrong hands, like your digital wallet, credit card or personal identity details.

Phishing scams

Scammers send emails or make cold calls pretending to be a legitimate agency or crypto exchange provider, promising a lucrative trading or mining scheme. They can be very persuasive in their language and tend to prey on people’s emotions.

You could also be asked for your private key (which is unique to each digital wallet that holds your crypto asset), personal identity details or credit card numbers. Scammers might persuade you to download software which gives them visibility to bank accounts and personal details.

Scam emails can include seemingly professional graphics and ads. They could ask you to follow a link or open an attachment, which could then direct you to a fake website or download malware onto your computer.

Investment schemes

These schemes work as pyramid or Ponzi schemes. They tempt you with a promise of high returns in a short period if you commit to a crypto investment opportunity. Just like any Ponzi scheme, payouts are funded by the money coming in from unsuspecting new investors. Scammers will encourage you to keep investing and add additional fees before you can withdraw the money. They may also share advanced graphs and fake trading platforms to show your investment returns to ensure you keep making payments towards the investment. Scammers will make you wait for your ‘huge returns’, sometimes paying you dividends so you believe they're legit and then they ultimately disappear – along with all the money.

Rug pulls and fake giveaways

Social media or online forums that promote fake new cryptocurrency opportunities or nonfungible tokens – luring you to invest by purchasing the tokens – but the scammers then disappear with your money. They could feature highly convincing deepfake celebrity accounts on social media, pretending to ‘endorse’ the scheme.

Fake exchanges for cryptocurrency

Fraudsters will tempt you with a fake ad (for example, on social media) promising access to a lucrative exchange platform that doesn’t exist – if you send them some money first. Be particularlyaware of ads which encourage you to sign up to invest in cryptocurrency and assigns you an account manager who helps you set-up bank accounts and crypto exchange apps. It’s crucial you do your own research and due diligence before proceeding with any investment opportunity.

Things to look out for

- Too-good-to-be-true promises of large gains on your investment in a short time frame, or ‘guaranteed returns’

- 'Celebrity' endorsements. Does this endorsement make sense? Is it endorsed by this person anywhere else? If it’s legitimate, why haven’t hundreds of people become rich using it?

- Any promises of free money, lack of detail about the investment and pressure to make the transaction immediately – no matter how persuasive the person sounds

- Cold calls, social media contact or emails out of the blue about an investment opportunity should raise a red flag. Hang up and don’t follow any links. Never transfer money, no matter what you’re promised

How to help protect yourself

- Always do your own thorough research. Be wary of false investment scams circulating on social media and online

- Check the FCA Register to make sure you’re dealing with an authorised firm. Make sure you check the FCA's Warning List of firms to avoid

- Refer to the Take Five to Stop Fraud campaign for helpful advice on what to look out for

- Speak to trusted friends, family members or an independent adviser before making any financial decisions

- Avoid clicking on links in emails about investment schemes, which could give a scammer access to your device through a malware download

- Delete unsolicited emails with obvious grammatical errors or misspellings, and ignore social media posts and ads

- Never give anyone access to your digital wallet. Protect it by using strong passwords and secure internet connections, or virtual private networks (VPNs)

Reporting a scam

If you’ve been a victim of a scam or suspect you’ve seen one online or through a cold call or email, contact Action Fraud UK and the FCA to file a report.

How your bank can help

Banks are constantly reviewing their fraud-profiling measures and response to fraudulent transactions. Review your own bank’s policies to learn more about their approach to crypto-related payments. For example, banks may enforce certain restrictions when you’re making a transaction involving a cryptocurrency exchange.

In addition, they could present you with a series of messages and warnings before you finalise a transaction as part of their security checks, and to ensure that you know the type of transaction that’s about to take place.

If you suspect you’ve made a payment to a fraudulent scheme, contact your bank immediately, so they can help work out what's happened and offer support. You should also change any passwords that you think might be compromised.

When someone uses manipulative tactics to sell an investment promising high returns, it can be very tempting to give them money, which could snowball out of control. It’s important to stop and do some research, seek advice and be alert to scams – especially as crypto assets are unregulated and you should be prepared to lose all your money if it turns out to be a scam.

If you think you might be the victim of a scam or fraud involving any of your Chase accounts, please contact us right away.

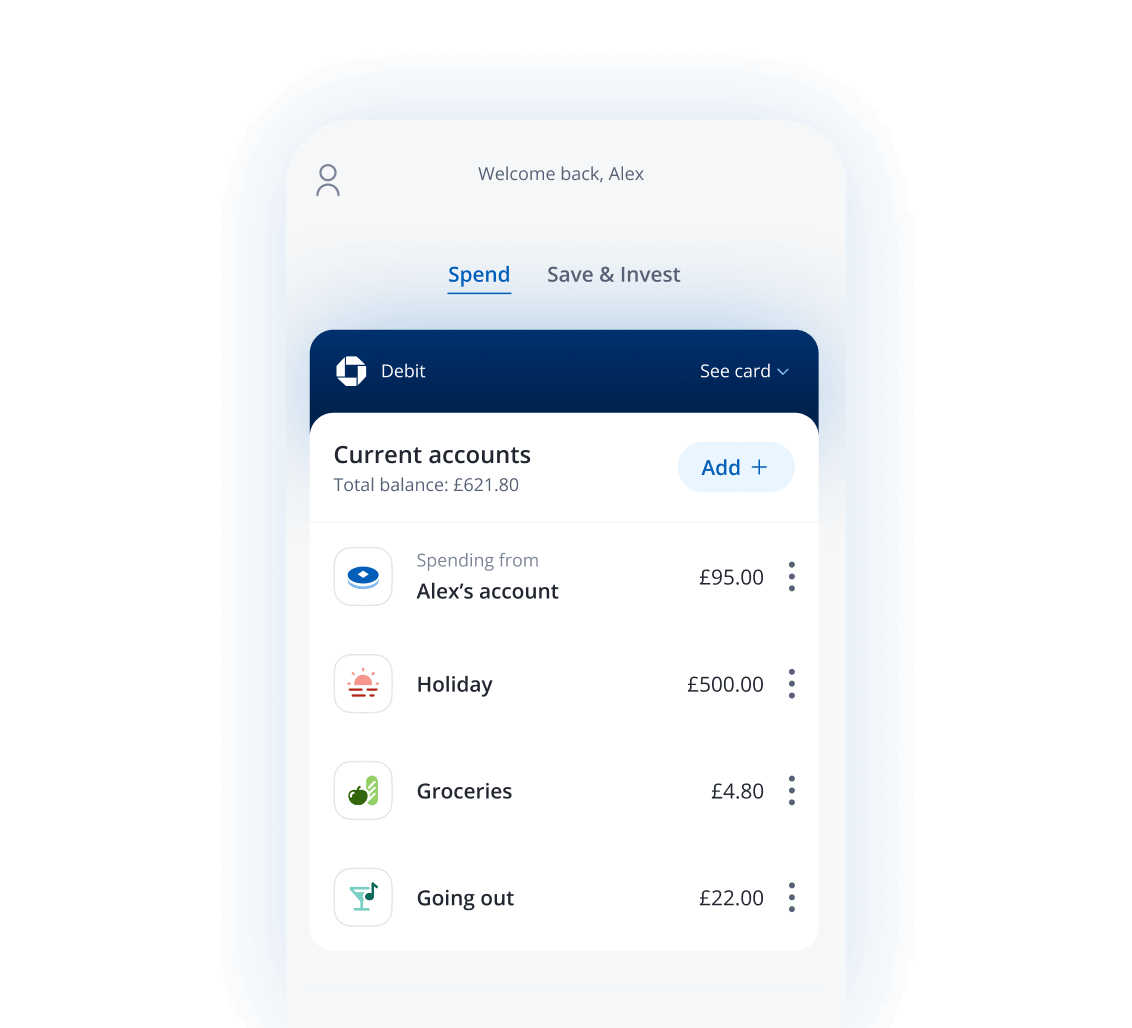

The new way to bank

Get to know the Chase current account. It's packed full of rewards and clever features that we think you'll love.